The Indian used car market is projected to reach 15 million units by 2030, positioning it to surpass new car sales. (Image credits: Wikimedia Commons)

Share Post

The Indian used car market is projected to reach 15 million units by 2030, positioning it to surpass new car sales. (Image credits: Wikimedia Commons)

The following analysis of the pre-owned passenger vehicle market dives into the top influencers of residual value in India, highlights key brand-wise and segment-wise trends, and explores how EVs, hybrids, and tech-savvy models are redefining the future of used car valuation.

India’s automotive landscape is rapidly evolving, with the used car market becoming a key driver of consumer choice and industry momentum. As affordability, digital platforms, and trust in pre-owned vehicles rise, buyers increasingly view used cars as a smart alternative to new ones. In this context, residual value—the estimated worth of a vehicle over time—has emerged as a critical factor shaping purchase decisions, financing, and ownership cost.

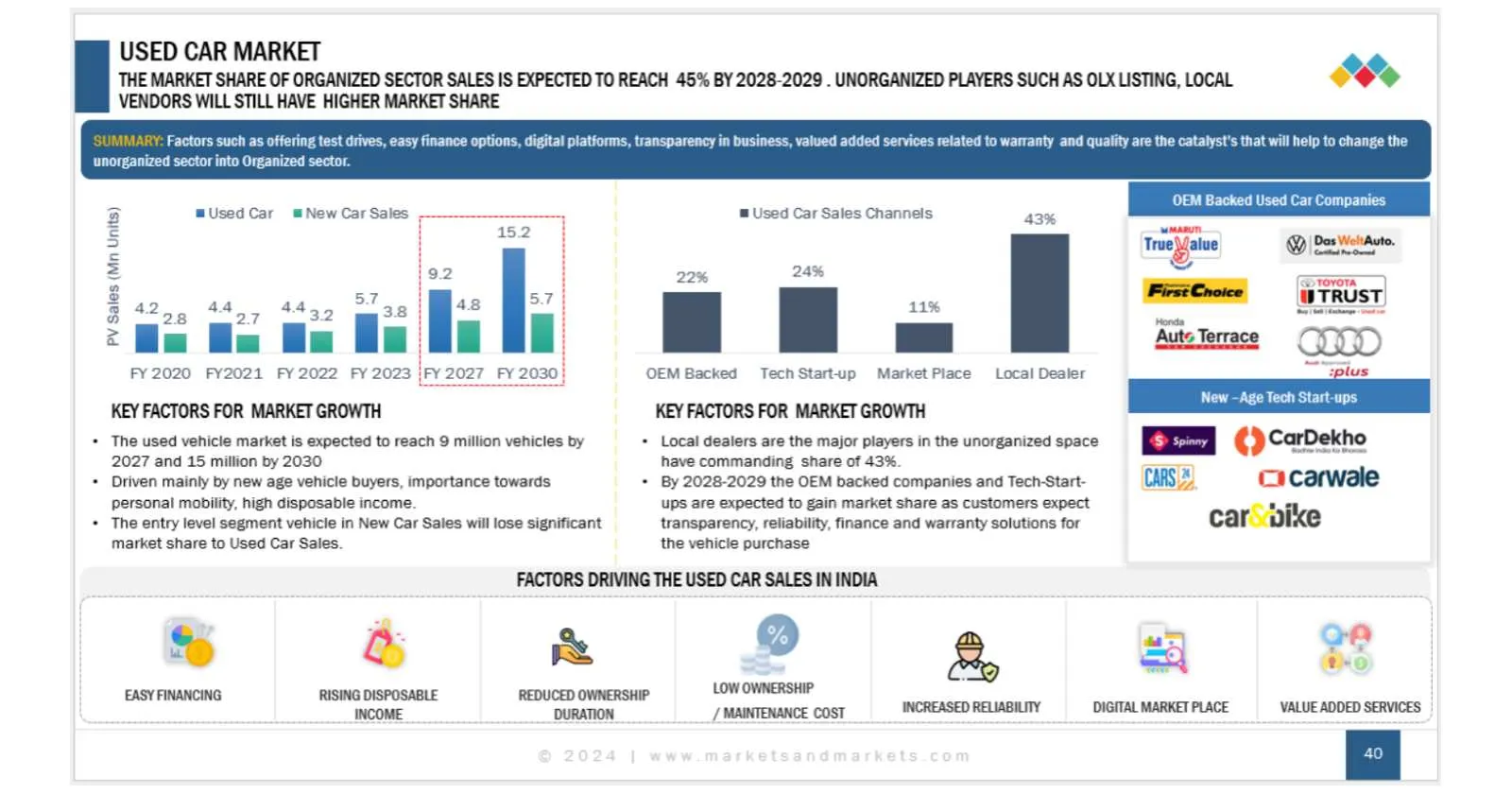

The Indian used car market is projected to reach 15 million units by 2030, positioning it to surpass new car sales. Historically, the market was fragmented and dominated by unauthorized dealers, making the pre-owned vehicle buying experience cumbersome and riddled with challenges such as trust issues, inconsistent pricing, and lack of transparency. Currently, nearly 80% of used car sales still occur through the unorganized sector, driven largely by independent dealers. The remaining 20% is captured by new-age tech firms like Spinny and Cars24, along with OEM-authorized used car dealerships such as Maruti Suzuki True Value, Hyundai H Promise, and Mahindra First Choice.

However, the market dynamics are rapidly shifting. By 2028–2029, OEM-backed platforms and tech-driven start-ups are expected to capture nearly 60% market share. This shift is driven by rising consumer demand for transparency, reliability, financing options, and warranty-backed vehicle purchases.

OEM-certified outlets have brought structure, standardization, and quality assurance to the pre-owned space. In parallel, tech platforms have transformed the customer experience by offering digital listings, vehicle inspections, financing, home test drives, and doorstep delivery. These innovations are building consumer trust and expanding market access—especially among younger, urban buyers seeking a seamless and dependable used car buying journey.

At MarketsandMarkets, we recently conducted a strategic Voice of Customer (VoC) study across four key Indian metros—Delhi NCR, Mumbai, Bengaluru, and Chennai—engaging with over 5,000 recent used car buyers. The objective was to decode the critical factors influencing residual value from a buyer’s lens and capture actionable insights on brand, model, transmission, fuel type, and usage patterns. This data-driven analysis offers a granular and strategic understanding of how consumer behavior, market dynamics, and technical attributes shape resale value, enabling stakeholders to align product, pricing, and positioning strategies in the evolving Indian used car landscape

Our Voice of Customer analysis uncovered strategic insights into buyer behavior around used car depreciation. Vehicle age emerged as the dominant factor influencing perceived resale value, followed by physical condition and verified service history—highlighting a strong buyer preference for tangible, usage-based indicators. While elements like brand reputation, transmission type, and fuel variant have traditionally been emphasized, they were deprioritized by most consumers, indicating a market shift toward more practical, condition-driven valuation metrics. These findings suggest that for stakeholders to enhance residual value perception, focusing on vehicle upkeep, transparency, and usage history is more impactful than relying solely on brand or technical specifications

Our 5-year residual value analysis, based on a baseline of 1-year-old vehicles with 20,000 km, revealed the following key findings for mass-market brands in India:

These insights underscore shifting consumer preferences and critical gaps in brand performance within India’s used car market.

Our analysis of fuel type and transmission impact on residual value revealed:

These trends highlight a practical, cost-conscious approach among Indian used car buyers

Electric vehicles (EVs) in India currently show significantly weaker residual value performance compared to ICE vehicles:

Key factors behind this steep decline include poor charging infrastructure, unclear warranty terms, and after-sales service gaps, all contributing to weak buyer confidence in the pre-owned EV segment.

India’s used car market is undergoing a power shift—where bold design, safety, and tech now trump legacy and mileage. Traditional giants like Maruti, Honda, and Toyota are on the verge of losing relevance if they don’t evolve fast. EVs may grab headlines, but hybrids and smart ICE vehicles are quietly winning the trust of real buyers.

E. Ramnath is a Team Lead – Automotive Advisory Services at MarketsandMarkets.

He specialises in Connected Cars, Telematics, Software-Defined Vehicles (SDVs), and Electric Vehicles. He has had stints at leading OEMs like Jaguar Land Rover and Great Wall Motors.

Nembharat App Announced with Zero Commission Model for Drivers

Acko Drive Team 23 Feb, 2026, 12:10 PM IST

Automakers Pursue Eyes-Off Driving Systems Amid Debate on Viability

Acko Drive Team 23 Feb, 2026, 12:06 PM IST

Mumbai to Get Unified Public Transport Services Across Rail, Metro, Bus, Taxi Networks

Acko Drive Team 23 Feb, 2026, 10:42 AM IST

New MG Plug-In Hybrid SUV Spotted In India For First Time

Acko Drive Team 23 Feb, 2026, 10:35 AM IST

Omega Seiki Files Patent for E-Rickshaw with Air Conditioner

Acko Drive Team 23 Feb, 2026, 8:02 AM IST

Looking for a new car?

We promise the best car deals and earliest delivery!