Vahan data showed a 13.8 per cent share in the passenger vehicle market in Q3 and an electric vehicle share of 43.6 per cent.

Share Post

Vahan data showed a 13.8 per cent share in the passenger vehicle market in Q3 and an electric vehicle share of 43.6 per cent.

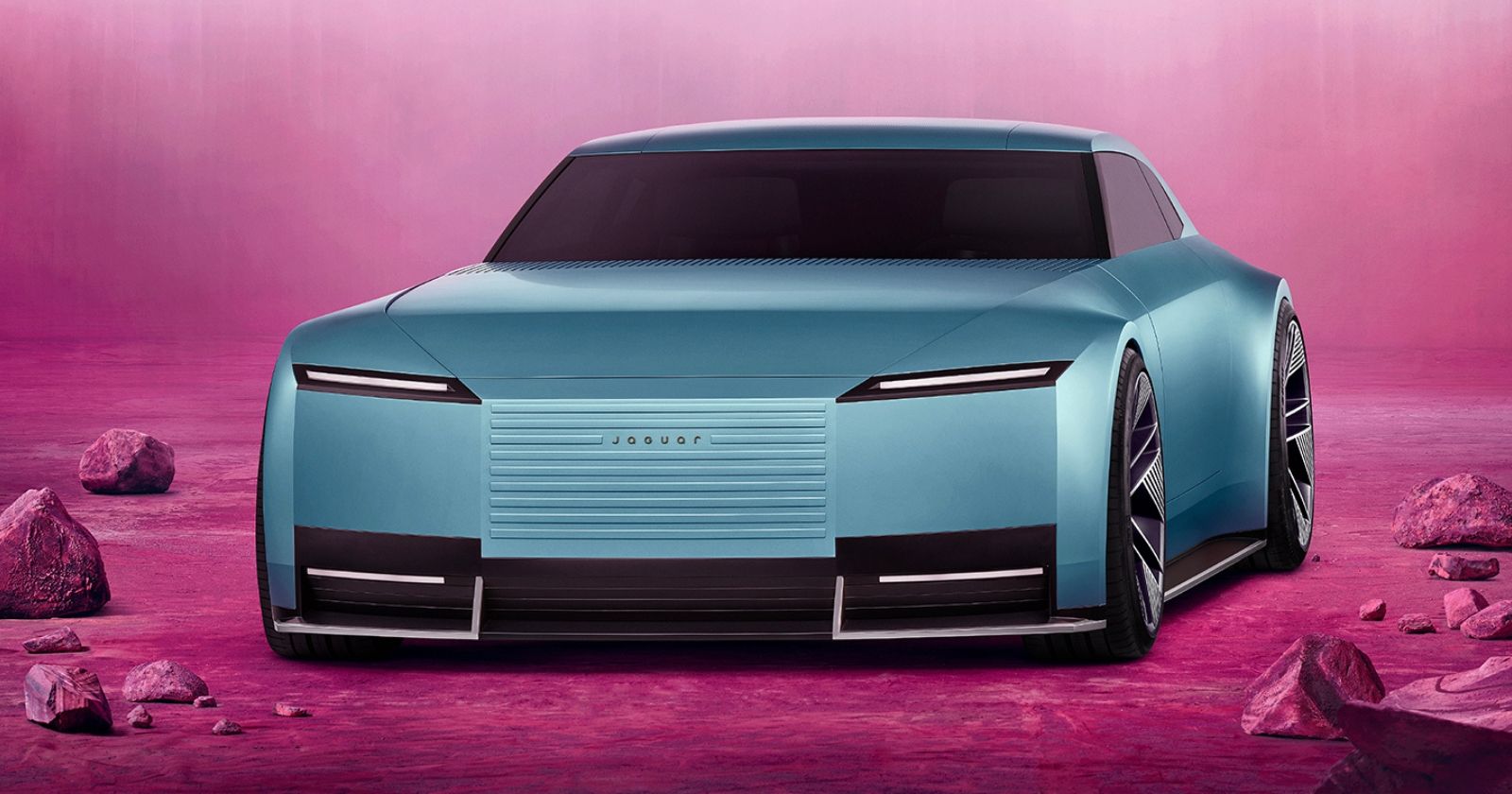

Tata Motors Passenger Vehicles Limited (formerly Tata Motors Limited) reported Q3 FY26 results that showed a loss at group level after disruption at Jaguar Land Rover (JLR), even as the India passenger vehicle arm recorded higher volumes and revenue.

Consolidated revenue for the quarter ended 31 December 2025 stood at ₹70,108 crore, down 25.8 per cent year on year. Operating margin (EBITDA) was 2.2 per cent and the company reported a loss before tax from continuing operations of ₹4,733 crore. Net loss from continuing operations was ₹3,483 crore. Free cash flow for the quarter was negative at ₹17,900 crore and net debt at group level was ₹39,400 crore.

JLR, which follows IFRS, reported Q3 FY26 revenue of £4.5 billion, a drop of 39.4 per cent year on year. EBIT margin was minus 6.8 per cent and loss before tax before exceptional items was £310 million. The company cited the cyber incident, a temporary production shutdown, slower demand in China and higher United States tariffs among the factors behind lower volumes and profit. JLR reaffirmed guidance for FY26 EBIT margin in a band of 0 to 2 per cent with a free cash outflow in the year.

In India, the passenger vehicle and electric vehicle business moved in the opposite direction. Tata Passenger Vehicles posted Q3 FY26 revenue of ₹15,317 crore, a rise of 24 per cent year on year, on volumes of about 1.71 lakh units, up 22 per cent. EBITDA margin for this unit was 7 per cent and EBIT margin was 1.2 per cent. The PV and EV business reported free cash flow of ₹300 crore in the quarter and a net cash position of ₹5,100 crore. Vahan data showed a 13.8 per cent share in the passenger vehicle market in Q3 and an electric vehicle share of 43.6 per cent.

Peers in the India car market remained in profit in the same quarter. Maruti Suzuki reported Q3 FY26 revenue from sales of about ₹47,537 crore, up 29.2 per cent year on year, with net profit of about ₹3,879 crore and total sales of 6,67,769 units. Hyundai Motor India posted Q3 FY26 revenue of ₹17,973.5 crore, up 8 per cent, and net profit of ₹1,234.4 crore, up 6.3 per cent, with total sales volume of 1,95,436 units. In contrast, Tata Motors group posted a net loss even as the India PV arm delivered higher volumes and revenue growth.

The good revelations in Tata Motors Q3 FY26 results lie in the India passenger vehicle and EV franchise. Volumes and revenue rose, market share in Vahan improved, EV penetration stayed in double digits and the PV and EV business carried net cash.

The bad signals are in margins and cash at group level. PV margins in India came under pressure from realisation trends, input costs and higher fixed charges, while group free cash flow turned negative.

The ugly part sits at JLR. Revenue fell sharply, EBIT margin moved into loss, the cyber incident and related costs weighed on earnings, and the group swung from profit a year earlier to loss, even as India car rivals such as Maruti Suzuki and Hyundai Motor India reported profit growth in the same quarter.

Rajiv Bajaj Calls Maharashtra EV Policy A “Failure”

Acko Drive Team 25 Feb, 2026, 6:01 PM IST

New-Gen Renault Duster India Launch Confirmed On March 17

Acko Drive Team 25 Feb, 2026, 1:22 PM IST

Toyota Land Cruiser & Lexus LX Recalled In India Over Gearbox Software Glitch

Acko Drive Team 25 Feb, 2026, 12:46 PM IST

Jetour T2-Derived SUV Officially Teased by JSW Motors in India

Acko Drive Team 25 Feb, 2026, 12:05 PM IST

Pune May Ban Vehicles Older Than 15 Years

Acko Drive Team 25 Feb, 2026, 11:55 AM IST

Looking for a new car?

We promise the best car deals and earliest delivery!