The Harrier is an SUV offering from Tata Motors. It has a powerful engine and a stylish design. However, this powerful and stylish SUV requires regular maintenance and servicing to ensure you can fully utilise its fantastic features.Here’s everything you need to know about the Tata Harrier service schedule and maintenance costs so that you keep your vehicle in top form.

The Maruti Brezza is a popular compact SUV among Indian car buyers and owners. It's hassle-free to own, which makes it a favourite for both city and highway use. However, even the most dependable SUVs require regular maintenance to remain safe and smooth on the road.In this blog, we'll guide you through the Maruti Brezza service schedule, spare part pricing, and estimated maintenance costs, as well as provide simple care tips to keep your Brezza performing at its best.

The Hyundai Creta is one of the most sought-after SUVs in the market. It is the highest-selling SUV since 2020 in India alone. The SUV is spacious, sturdy, and reliable, making it easy to use for both daily travel and road trips. But like every vehicle, the Creta needs regular check-ups to stay in top condition. The best part? Its maintenance routine is simple and easy to follow.Take a closer look at the Hyundai Creta’s service schedule and maintenance costs including replacement part costs, and some useful upkeep tips in this guide.

Experiencing frequent engine stalling can be frustrating and even dangerous for any car owner. Whether your vehicle shudders at traffic signals, loses power while driving, or suddenly dies without warning, stalling disrupts your journey and can create unsafe situations on the road.While minor stalling can sometimes occur due to simple issues, repeated engine stalls often indicate an underlying mechanical or electronic problem. Identifying the cause early allows you to address it promptly, restore your car’s performance, and prevent costly breakdowns in the future.In this blog, we’ll explore why engines stall, the most common causes of frequent stalling, how to troubleshoot the issue, and steps you can take to prevent it from happening again.

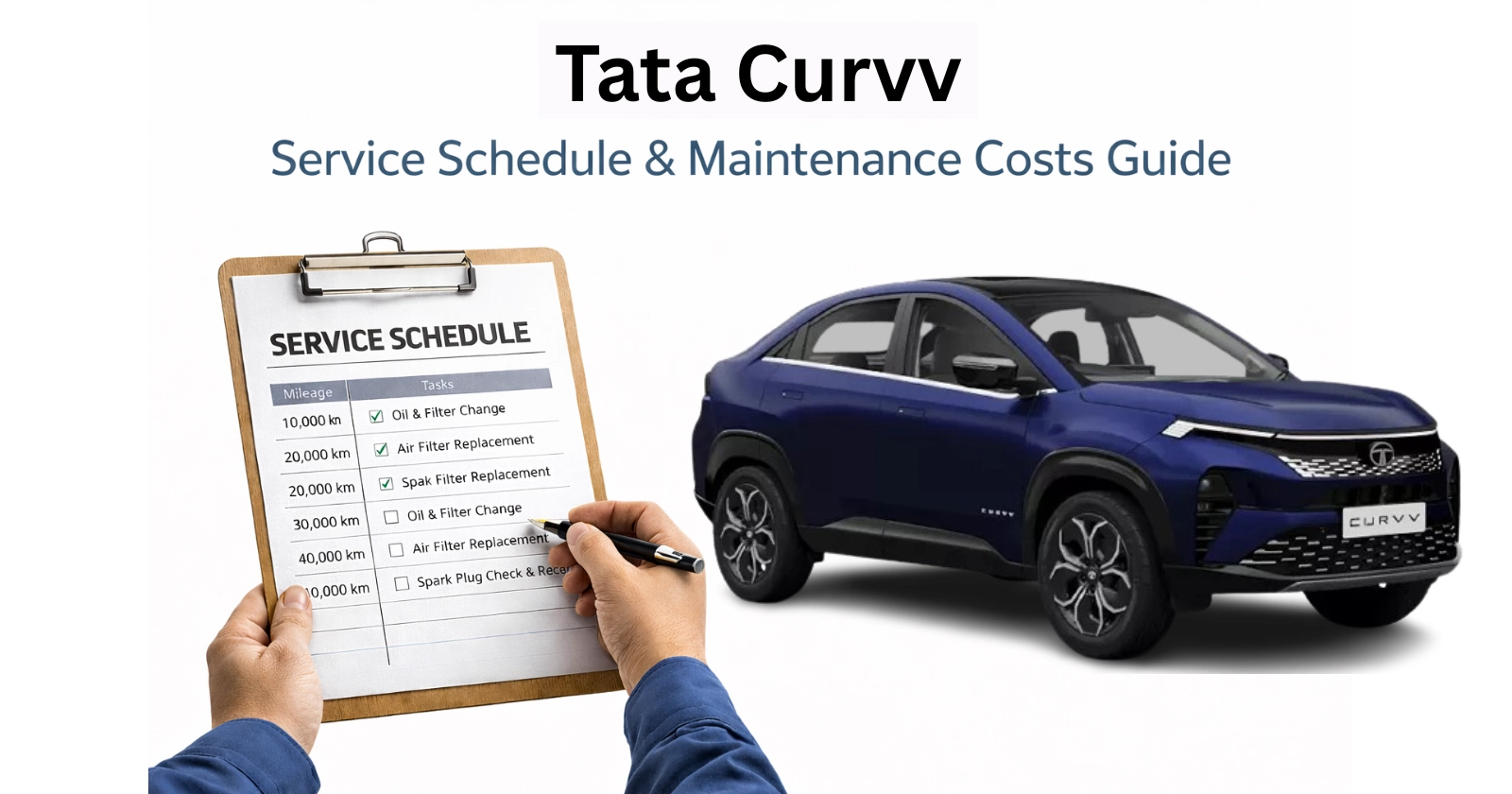

Ever wanted a car that looks like something between a coupé and an SUV? Tata Motors has turned this unique dream of yours into reality with the Tata Curvv, India’s first SUV coupé. With its unique sloping roof and modern design, the car is pure luxury on wheels. Maintaining and servicing the car regularly can make this luxury last a lifetime. To keep your Tata Curvv in optimal condition, regular servicing and maintenance becomes crucial. Read on to know more about the Tata Curvv service schedule and maintenance costs.

Cruiser bikes have always been close to bikers' hearts. They are all about fashion, comfort, and the thrill of riding. Amongst India's cruisers, the Royal Enfield Meteor 350 has become a favourite. Affordable, fashionable, and comfortable, the Meteor 350 is meant to make the cruiser experience more accessible to more people, not merely to owners of premium bikes.In this article, you will discover the Meteor 350, its design, performance, features, comfort, and market performance.

The Maruti Baleno continues to be one of India’s best-selling premium hatchbacks, thanks to its strong reliability and low running costs. But like any car, it performs best when it’s maintained on time. That's when understanding the Maruti Baleno’s service schedule, maintenance costs, and common consumables comes in - it helps you plan better and avoid unexpected expenses. Whether you drive daily in the city or take long highway trips, keeping up with routine servicing goes a long way in extending your Baleno’s life.Let's take a trip down this blog to read more about Maruti Baleno’s service schedule, spare part costs, overall maintenance costs, and some simple care tips.

The Hyundai Aura is a car that feels like a companion. It's compact, efficient, and low-maintenance. Still, like any car, it requires regular maintenance to stay in top shape.If you're unsure about its service schedule or maintenance costs, you have come to the right place. In this guide, you’ll find everything about the Hyundai Aura’s service schedule and maintenance costs, and what you need to do to take care of your car.

The Tata Altroz is a premium hatchback offering from Tata Motors. It is one of the safest hatchbacks on the market with a 5-star Global NCAP safety rating. Packed with features that enhance your on-road experience and comfort, this premium hatchback is made for city and highway journeys.Here’s a detailed look at the Tata Altroz service schedule and maintenance costs so that you can get the most from the car in terms of performance and longevity.

When it comes to budget-friendly, reliable city cars in India, the Maruti Alto K10 stands out as a go-to option. Affordable to buy, fuel-efficient, and easy to maintain - these are among the many reasons why a lot of owners appreciate this hatchback.In this article, we’ll walk you through the Maruti Alto K10 service schedule, spare-part costs, overall maintenance costs, and handy tips to keep your Alto K10 running smoothly.

Mahindra Bolero Mileage: Real World vs ARAI Mileage

Acko Drive Team 9 Mar, 2026, 11:20 AM IST

Mahindra XUV700 Mileage: Real World vs ARAI Mileage

Acko Drive Team 9 Mar, 2026, 10:19 AM IST

Top 10 Best-Selling Bikes in January 2026

Team Ackodrive 16 Feb, 2026, 3:46 PM IST

Top 10 Best-Selling Cars in January 2026

Team Ackodrive 16 Feb, 2026, 3:12 PM IST

Honda Amaze Service Schedule and Maintenance Costs

Team Ackodrive 6 Feb, 2026, 2:51 PM IST

Looking for a new car?

We promise the best car deals and earliest delivery!