Despite prevailing global headwinds, auto components export grew by 9.3 percent to USD 12.2 billion, resulting in a very narrow trade deficit.

Share Post

Despite prevailing global headwinds, auto components export grew by 9.3 percent to USD 12.2 billion, resulting in a very narrow trade deficit.

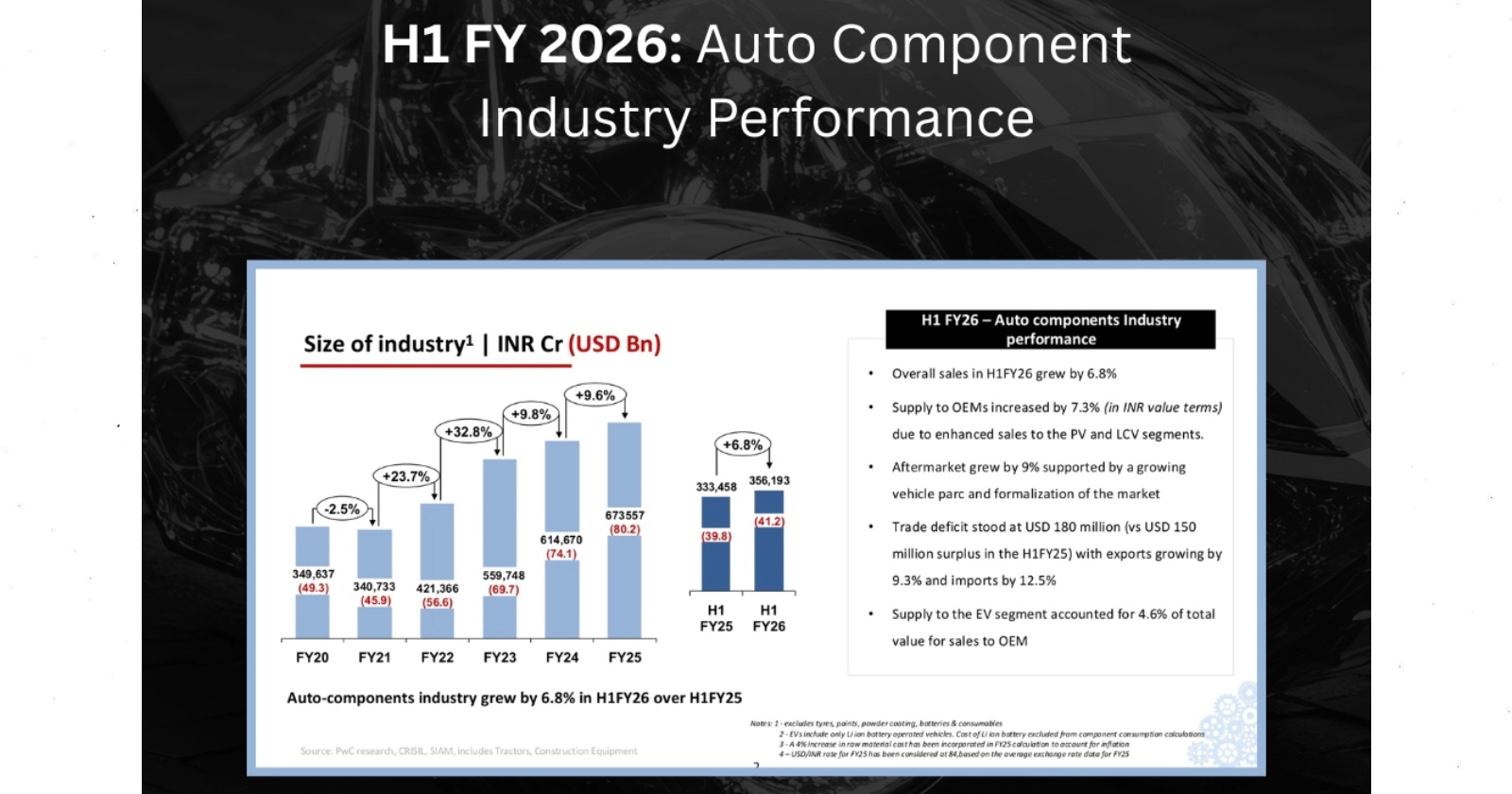

In the midst of rising geopolitical instability, the Indian auto component industry maintained its composure, registering an overall growth of 6.8 percent to ₹3.56 lakh crore in H1 FY26 compared to the same period last year. Further, the Automotive Component Manufacturers Association (ACMA) of India reported that supply to OEMs rose by 7.3 percent to ₹3.04 lakh crore during the same period, led primarily by the passenger vehicle and LCV segments.

This growth was aided by several factors including stable domestic demand, a resilient aftermarket, and continued investments in capacity expansion, localisation and technology upgradation. This in no way implies that the industry was unaffected by the surrounding challenges.

In a recent interaction with Vikrampati Singhania, President, ACMA, and Vinnie Mehta, Director General, ACMA, Acko Drive gained insights into the key challenges and emerging opportunities shaping the Indian auto component industry.

One of the major challenges that has amplified over the years is supply chain constraints faced by component manufacturers. When inquired about the same, Vikrampati Singhania explained that geopolitical tensions have disrupted freight routes, increasing freight rates and shipping times, which has in turn has raised working capital requirements.

A major concern remains the limited availability of rare earth materials, critical for motor manufacturing, particularly in hybrid and electric vehicles. With China controlling around 85 percent of the global rare earth minerals market, availability has been inconsistent thanks to the constraints in political and diplomatic relations between the two countries. This led to a major gap in the supply chain when China announced curbs on export of rare earth materials in several countries including India.

To negate supply disruption, the Government of India introduced a new scheme last month to promote manufacturing of sintered rare earth permanent magnets (REPM) in the country. With an ₹7,280 crore. The scheme aims to establish 6,000 metric tonnes per annum (MTPA) of integrated REPM manufacturing capacity in India, covering the full chain from rare-earth oxides to finished magnets.

However, Singhania noted that implementation of this scheme will take effect in 18-24 months from now. In the meanwhile, manufacturers have managed to source rare earth components from alternative countries albeit at slightly higher costs. He further added that auto OEMs are also exploring new technologies such as magnetless motors, light rare earth alternatives, and materials like neodymium.

He added, “This is a concern for the short-medium term. In the long run, I'm assuming that this will be solved. The Government is trying and we can continue to only support the Government in trying to unbottleneck this specific issue.”

Amidst global headwinds, exports from the Indian auto component industry grew 9.3 percent to $12.1 billion (approx. ₹1.09 trillion) in H1 FY26. USA and Germany, were among the top destinations for Indian auto components, accounting for 26 percent and 9 percent of total exports. During the conversation, Singhania highlighted why USA remained India’s top export destination for components despite unfavourable relations ever since Donald Trump came into power in January 2025.

“While there are global demand shifts taking place, exports to the USA remain stable from a supply chain perspective. The real impact, I think, of the new tariffs will start coming in the second half of the year, if any. Number two, other markets have continued to grow. So that has aided the flatness of the US market”, said Singhania.

When asked whether dependency on China will reduce soon, Vinnie Mehta emphasized that the auto component industry is part of a global value chain, imports and exports are a normal part of business. He added that imports from China persist due to China’s technological advantages, high production volumes, and the location of multinational companies’ mother plants there.

Also READ: Auto Component Industry Grows 6.8% in H1 FY26, Exports Rise 9.3%

Mehta pointed out that India’s market, producing about 5 million cars compared to China’s 30 million, cannot yet compete on price. However, efforts are underway through organizations like ATMI and SIAM to reduce dependency gradually as domestic capabilities improve.

“We are hopeful that in time to come, as our capability develops, there will be some reduction in that (imports). But I don't think so it's in anybody's interest, and let's say hopefully now the relationship between China and India is tying up. For all you know, there could be Chinese investments with Indian partnerships in some of the technology areas that we are importing and that could also help reduce imports from China,” said Mehta.

On currency fluctuations, Mehta explained that in the short term, currency risks are mitigated through hedging. In the long term, depreciation of India Rupee (or strengthening of US Dollar) benefits exporters but harms importers. The industry’s imports and exports are roughly balanced, therefore, the overall impact has stayed neutral. Export-oriented firms benefit from a weaker rupee, while import-oriented firms suffer losses.

H1 FY 2026 | H1 FY 2025 | Growth | |

Industry Turnover (INR Cr) | 356,193 | 333,458 | 6.8 % |

Supply to OEMs (INR Cr) | 304,663 | 283,848 | 7.3 % |

Aftermarket (INR Cr) | 53,160 | 48,771 | 9.0 % |

Exports (USD Bn) | 12.2 | 11.1 | 9.3% |

Imports (USD Bn) | 12.3 | 10.9 | 12.5 % |

When asked if the trade deficit has narrowed in recent years, ACMA officials confirmed that for auto components, the trade balance has been narrow over the last few years. In fact, the previous year even saw a small surplus, while the current half shows a slight deficit. Overall, despite technological shifts, the sector has maintained stability.

With software-defined vehicles (SDVs) becoming more common across the globe, the adoption of newer technologies has become very critical. Mehta noted that product development cycles have shortened from five years to roughly 1.5–2 years. The industry has successfully adapted to this pace, as evidenced by recent SDV models in the market. Although India still lags in the EV electronics ecosystem, initiatives like the Ministry of Heavy Industries’ PLI schemes are encouraging investments in domestic electronic manufacturing.

However, there is still a long way to go for the Indian market when it comes to EVs and power electronics components. Mehta pointed out that low EV demand limits the incentive for large-scale component production. Out of 5 million cars, only about 200,000 are EVs, and among 24 million two-wheelers, only 1 million are electric.

He also highlighted the emergence of new sub-industries, such as electronics manufacturing services (EMS) companies working on LCD screens and camera systems. He conceded that transition to EVs, SDVs, and advanced electronics will be gradual but steady, mirroring the evolution of the broader automotive industry.

Also READ: New Low-Pressure Solid-State Battery Design Marks Major Research Milestone

When asked about the most pressing regulatory bottlenecks that need immediate policy attention, Mehta expressed satisfaction with the government’s responsiveness, noting that the auto industry has received fair hearings from policymakers. He highlighted strong growth trends and India’s position as a global investment hotspot.

The ACMA officials went on to commended the government for major initiatives like GST reduction and various Production-Linked Incentives (PLI) for auto components, batteries, etc. which later meta-morphosized into the PM e-Drive scheme.The officials further revealed that a forthcoming policy on global value chain integration is also in progress and should be out in the coming months, although details of the same are still withheld.

While acknowledging that not all policies can align perfectly with industry desires, he concludes that the government’s efforts are balanced and commendable, especially for a developing economy. “We get heard very well by the commerce minister, finance minister, and foreign minister. So we don't have anything to complain about.You can always ask for the moon but at the end of the day, you must also keep in mind that you are a developing economy,” concluded Mehta.

Auto Sales February 2026: Greaves Mobility Strengthens Position in Electric Bike Market

Acko Drive Team 1 Mar, 2026, 1:09 PM IST

Auto Sales February 2026: Royal Enfield Sales Rise 11% YoY

Acko Drive Team 1 Mar, 2026, 12:00 PM IST

Tata Motors Passenger Vehicles Reports 35% Sales Growth in February 2026

Acko Drive Team 1 Mar, 2026, 10:45 AM IST

Auto Sales February 2026: MG Motor India Records 24% Sales Growth

Acko Drive Team 1 Mar, 2026, 10:00 AM IST

Mahindra XEV 9e Cineluxe Edition Launched at ₹29.35 Lakh

Acko Drive Team 1 Mar, 2026, 8:57 AM IST

Looking for a new car?

We promise the best car deals and earliest delivery!