The company has been in India for nearly 20 years and employs 40 percent of its workforce here.

Share Post

The company has been in India for nearly 20 years and employs 40 percent of its workforce here.

Many of us use maps on our phones to find places and get directions every day, but these days, navigation and location technology is embedded in our digital lives far beyond the apps on their phones. More and more devices and services, and even the infrastructure in our connected world, relies on precision positioning, especially as we move to more autonomous and intelligent technology. One company in this space that you might have heard of, Here Technologies, develops the maps and information database used by many automobile manufacturers, commercial transportation operators, and other service providers. Originally founded as Navteq 40 years ago, it was acquired by Nokia, becoming one of the first map apps on mobile phones. Currently an independent company, it is backed by a surprising consortium of owners including Audi, BMW, Intel, Mitsubishi and Pioneer.

ACKO Drive recently sat down for a conversation with Abhijit Sengupta, Senior Director & Head of Business for Southeast Asia and India at Here Technologies, to see what the company is up to and how it’s positioning itself for the future.

ACKO Drive: As far as India is concerned, Here is not one of the more popular mapping app names for end users. Is that a deliberate choice?

Abhijit Sengupta: Here is not new in India, but we've always been a B2B brand. We were part of Nokia as a consumer brand, but our primary visibility is with our B2B customers. Having said that, we do have a consumer application called HereWeGo, which is on the app stores and anyone can download and use it.

We have been in India for almost 20 years; it was part of the expansion plan back then. We started to develop our product, and I was hired as one of the first employees back then, which is 2008. I came from a telco background. Today we are a 3000+ employee-strong organisation in India in multiple cities; we operate in Mumbai, Bangalore, Gurgaon, Pune, and Hyderabad.

We have teams that are taking care of go-to-market activities in India, managing government relationships, maintaining mapping for India, and product management which is defining the roadmap for what we need in India.

Additionally, we have engineering and development teams that do things like development for OEM solutions. Global map operations, which is literally building the 2D and 3D maps, that's also out of India.

How much of a focus is the HereWeGo app for the company?

HereWeGo is a consumer asset which is available for both the Apple and Android ecosystems. We are not in the business of monetising it, but it’s being propagated as a consumer application. It remains a focus for us in India. This is a consumer touchpoint. We do talk about it at all the events we are present at, for example the Auto Expo. So that's how we are going to market.

Can you talk a little about the company’s primary activities?

Sengupta: We have been running our location tech platform for the last 19-20 years, which caters to various segments – automotive, two-wheelers, enterprise, supply chain, logistics... anything and everything related to the movement of people, goods and services.

One area that we’re focusing on going forward is road safety. We believe this is very, very important and it gets called out every time we talk to drivers. It's a very broad topic; it’s a technology topic; it’s an OEM topic; it’s a connectivity topic.

And then we're also focusing on local innovation, and a couple of strategic partnerships, for example we have a global partnership with Uber which is helping to improve traffic data in India.

There are some localisation needs at a B2B level, very specific to that B2B requirement, so for that we have an application called Here Navigate. This is an out-of-the-box navigation solution for automobile companies, built on the HereWeGo SDK. We provide all kinds of customisation possibilities to the OEMs.

So is it a white label product for others to offer?

Yes, it's a white label offering, it's customisable; the colour scheme, branding, etc to make it more relevant for drivers. That's how we look at the HereWeGo tech stack.

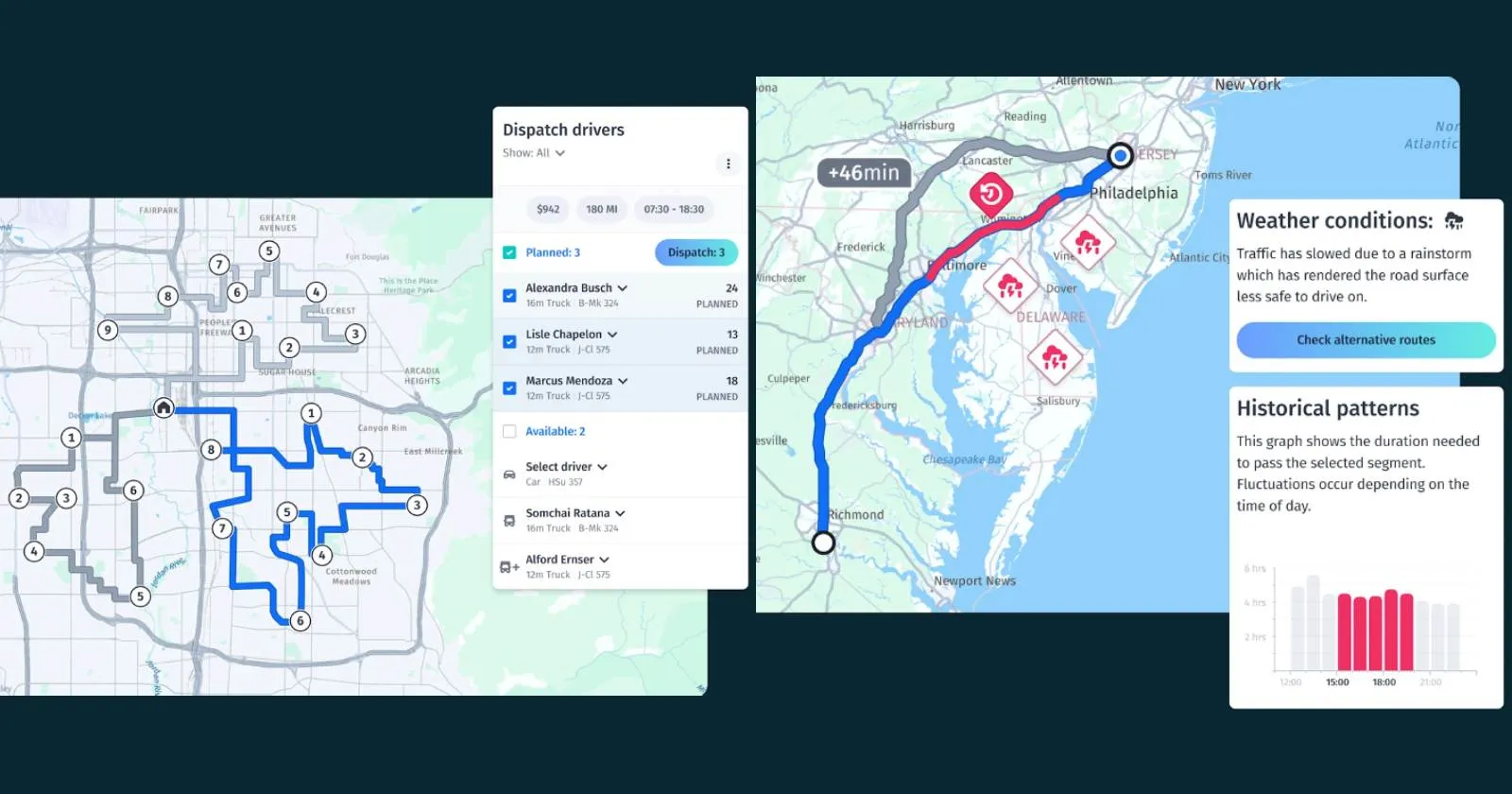

We also have HereWeGo Pro for the commercial vehicle segment. This is bigger, it’s more of a tool for productivity and efficiency in the OEM space along with of course navigation, traffic data, etc.

How are the B2B and B2C apps different, and what makes a B2B app specifically useful to the client?

On the B2B side, Here Navigation is customised for specific OEMs.They can run very specific programmes based on analytics which our application can provide, like how a particular OEM’s customers are using search. They can then potentially monetise this asset, taking it to advertisers if they want to. So it's basically creating a digital asset, which is of course productive, and brings in safety and convenience.

HereWeGo Pro brings in capabilities around trucks, which need a very specific type of routing, and this is again linked to efficiency as well as specialised requirements.

Can that be integrated with the clients logistics operations and driver management tools?

Correct. This is huge; logistics is a multi-billion dollar sector, especially in a country like India where goods move thousands of kilometres and multiple decisions have to be made. There are dollars attached to those decisions, for example how efficiently the last mile is delivered or the middle mile travels; and driver visibility and productivity. These are popular use cases these days because more and more such operations are going through a digital transformation.

You named Uber earlier. Can you talk about any other specific clients?

We use Uber GPS probes to enhance our traffic data. As you would imagine, those taxis move around in the city frequently and are always connected. Therefore they give back the GPS probe, which really helps to improve our traffic product. We've been running the traffic engine for years and years, and we take that GPS probe to improve those further.

Can you talk about what you're doing with any other clients or companies or can you name them?

One company that’s probably getting a bit of attention in India is VinFast, which is launching with us, using Here navigation. It is already in multiple markets; Vietnam and others.

Customers like to work with us because of our local presence, that's very, very important because maps are extremely localised. So think of OEMs in any country that have international ambitions, for example many Chinese OEMs work with us for their export markets.

What about any Indian manufacturers or anybody participating? Any Indian company in the automotive ecosystem?

We have worked with some of the two-wheeler companies. For one of them, we’ve worked on their EV range. We have not gone public but that's an area where we are seeing lots of traction. We also have commercial vehicle companies that work with us for truck use cases.

Do you handle software updates or is that up to OEMs?

That’s a good question. There are actually two steps to software updates. We of course create the updates; Here Navigation has a software-first approach or connected-first approach.

We provide the update to the OEMs and then they manage the updates. They all have their own mechanisms, over-the-air, or some of their customers have to bring their cars to a service centre. So it all depends on the OEM strategy, but we work very closely with them.

On the note about Indian companies, can you talk a little bit about your work with Genesys?

Yes, we recently announced our partnership with Genesys to support ADAS use cases, because that requires high-precision HD maps. They already have that capability in India. On the software side, UI UX, and development, we have worked on various ADAS and Navigation-on-Autopilot (NOA) solutions in many countries for many years. So we will use our expertise, but utilise the Genesys HD maps and leverage the database it has already created.

We bring components like the vehicle sensors and cameras. We call it E Horizon, because when the vehicle moves, it needs to look around the horizon. That data sits on top of the map, so when the car is not able to see, it can use the HD map information to allow Level 2 or 2.5 hands-off driving. We build all these things together and then bring this solution to the OEMs.

Does that rely only on GPS, or are you using sensors such as Ultra Wide Band and LiDAR?

GPS gives latitude and longitude information, which is two-dimensional: X&Y. But here you need a Z axis; a third dimension as well. ADAS use cases need more precise data so that you can take your hands off the wheel, at Level 2.5.

For Level 3, when the car is moving, it should really be aware of the environment around it, what's on the horizon, if there is a car in front, some objects, etc. So we still use GPS which will determine the position of the car, but then its sensors and cameras will let the driver take their hands off, wherever available. We create that tech stack.

On that note, what do you think about Indian developments in that space? Particularly about NavIC and Digipin, how are they going to come into play?

The objective of Digipin is to handle the Indian condition of unstructured or asymmetrical addressing, and it’s really helping. It’s an alphanumeric value and it really helps to identify a location. The resolution is 4m by 4m.

We are integrating Digipin as a destination or an origin point for different use cases. It can be helpful in automobile navigation, last mile delivery, e-commerce, etc. Digipin brings more context, and NaviC is a constellation of satellites which serves the same purpose as GPS, which is latitude and longitude [determination]. Both are helpful.

You touched upon safety earlier in the context of ADAS and I presume eventually autonomous driving is something that the company is also looking into. What sort of initiatives do you have, particularly for Indian conditions?

Right. Statistically speaking, a significant number of road accidents happen on highways. They could be linked to various factors such as poor decision-making, driver behaviour, or road conditions. Roughly 80,000 people die each year, and that’s a huge number. We did a survey last year, and close to half of all respondents had some experience of an accident – so anyone who's driving, half of them have gone through this kind of experience.

Then there are two-wheelers, which are high-volume in terms of vehicle sales. Per year, close to 18 billion two-wheelers get sold every year, and there are hundreds of millions on the road. So that is a huge challenge, with poor visibility, traffic pattern issues, sudden lane changes, sudden braking, potholes, etc.

We believe that ADAS as tech intervention is very helpful, it's basically aiding awareness. The technology can help drivers. Not only human intelligence, but also the car is also using data to avoid certain conditions. We are also engaging with various agencies, the government agencies including the Automotive Research Association of India (ARAI) and the Central Institute of Road Transport (CIRT).

ARAS, or advanced rider assistant system, is also being seriously considered by two-wheeler manufacturers. Our play will be HD maps, real-time traffic, and hazard warnings.

Our SDK can identify traffic coming from the other side of the road, against the regular flow of traffic. Especially on highways, you suddenly see a truck coming, for example.

We are working with various technology and mapping partners, and government and research agencies on these initiatives. We are bringing the ecosystem together. It’s not a silver bullet; there is no silver bullet, unfortunately.

OK, so it's early stages. What do you think the penetration for features like this will be?

If we take some of the global benchmarks, most of the automobile ecosystem swiftly moves to adopting [this technology]; it becomes very, very standard.

Do you think users prefer to access information and services like this through a car’s built-in systems, or on their smartphones? How do you approach this balance, especially when it comes to delivering updated information?

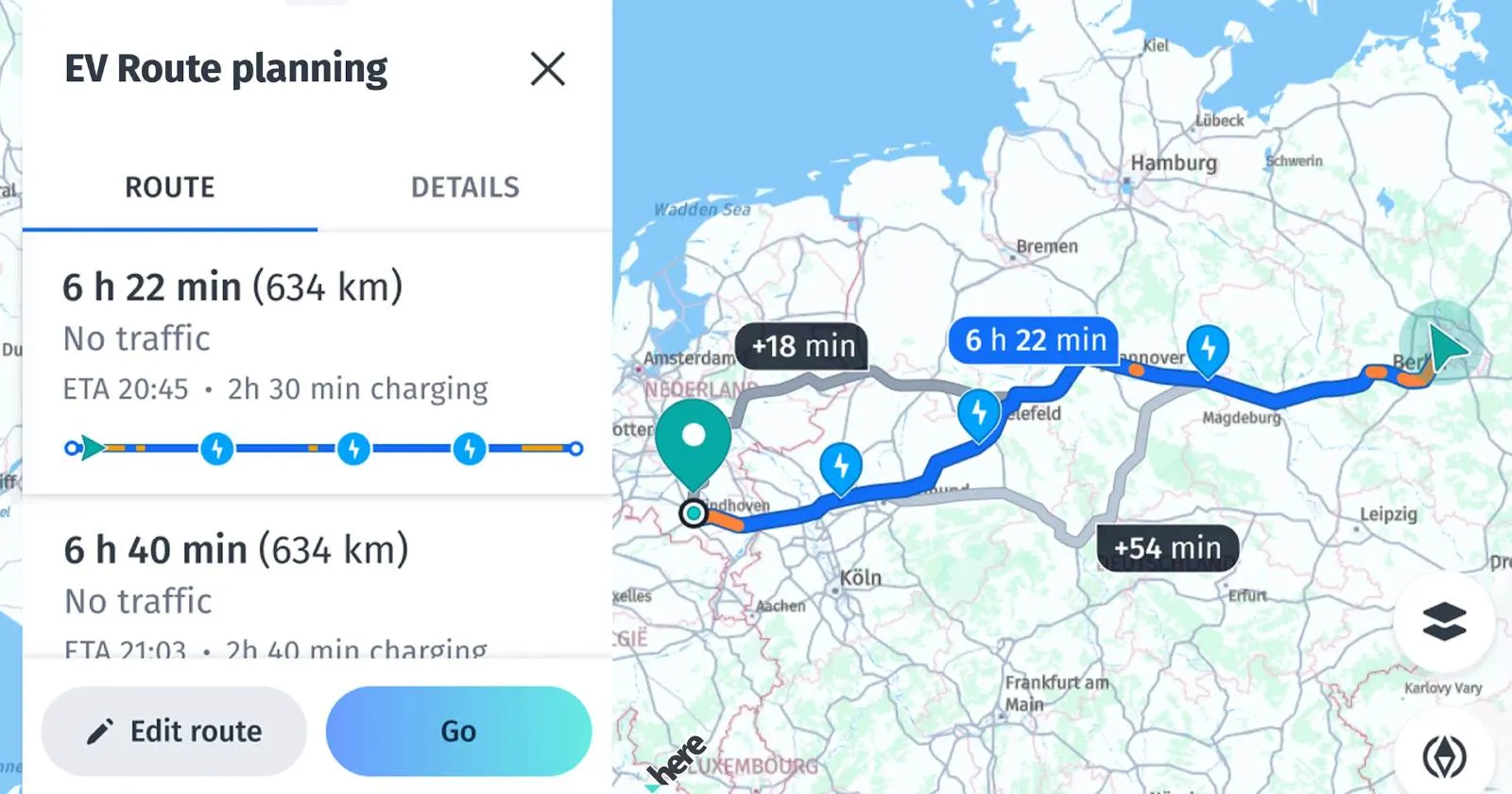

One use case is electric vehicles. This works well in the OEM environment because that application needs to connect to the battery of the car. Applications for electric vehicles are super powerful, whereas a mobile application will not be that useful. Our product’s charge-aware routing is based on battery consumption, so it's more powerful when it’s immersive through the OEM experience.

Coming to freshness and updates, these are all streaming applications, which means they are always connected. If anything changes in the real world, it gets captured and gets on the application layer in a couple of days. Important changes might show up in 48 hours.

Before this [capability], updates would not happen in time, and therefore having a mobile phone would be much easier and better. But now that everything is connected, you have a bigger touchscreen, better search, so it’s very powerful.

You said that OEMs can monetise updates and fresh information. How are they doing this, and does the end user have to worry that one day updates will just be turned off?

It's a pure OEM strategy. We work with the OEMs, and they then work around their connected vehicle strategy. What we have seen in some global markets is their monetisation model could be some advertising, or it could potentially be some services or a subscription-based model. So it’s up to the OEM, how they want to bring it to the customer, and we provide all the support to them.

It can be updated on a FOTA (free over-the-air) basis. And if we develop a new feature, an OEM can take advantage of it because it's a software upgrade. The kind of world we are in now is software-defined, and it's all a software-first experience. So you don't have to wait, or change the car to change the experience! For Here Navigation, we have made close to 100 upgrades in 18-20 months. That's the pace of upgrades we keep [providing] to the OEM to deliver to their customers.

How much of the situational awareness information shown to drivers is generated on the vehicle by its sensors, and how much comes in through a data connection from you and your resources?

The starting point is GPS and positioning; the car needs to know where it is, what its position on the map is, and then it starts to draw the traffic, the map tiles for example. We provide hazard, traffic, road closure and diversion information – that will come on the map side of things. Also, EV charging information, charging point availability. We work with the charge point operators to bring that information on the map. Then situational awareness from the sensors or the camera stack, the car brings into the application.

Do you see that line shifting? Are on-vehicle capabilities going to grow, to the point when each car is basically generating its own real-time awareness?

Absolutely! It’s becoming software-defined. For example, the wiper starts when it rains, and that creates a bit of data. That’s situational data even before a weather API can send it. That's why we call it VSD, or vehicle sensor data. It’s analysed and we derive certain information out of it. If there is a bumpy or curvy road, and there are jerks, all of this data comes together.

And then will what one vehicle detects be fed back through your common cloud to everyone else?

Yes, there's an OEM cloud and then there’s our cloud. So there are two collections of information. OEMs would like to keep some information to themselves, because at the end of the day, it’s proprietary data owned by them.

What do you see as the future of maps, in terms of user experiences like augmented reality, more connectivity, real-time information changing, and of course AI. And what are you already doing in that regard?

More and more cars will get connected, and will use connected services. That is the starting point. Beyond the standard telematics kind of requirements with passenger vehicles, you will have more and more connected applications and navigation will be one of the key applications that a driver requires.

Within that map, we would see real-time traffic. Autopilot and ADAS use cases will start to be built in, and we will also see lots of personalisation. In fact, we are [currently] able to personalise our services based on driver preferences. So if I log in I have a unique user ID, but if you use the same vehicle, there could be a different profile which is purely based on our individual behaviour, preference of routes, preference of points of interest, etc.

In the India context, one car might be driven by more than two drivers in a family. Every profile is a different individual, with their gender, age, demographics, etc. So that is going to be very common. These personalised experiences also lead to personalised monetisation options.

And then AI comes to the picture with all these language models, when interaction with the application is at a different level. It's not “take me [to the destination]”, it could be “Can I pick up…?”, “Can we go via this restaurant to my home?”, and those kinds of intuitive, prompt based interactions.

That has already started to happen, so we use it in our applications. With these large language models, you're not just searching for a pizza, but searching for pizza which has a five star rating.

So that's also personalised, there’s more and more interactivity with the in-vehicle navigation and infotainment systems, and then of course the data which the car generates will potentially be overlaid.

The opportunities for monetisation, we support with lots of analytics to the OEMs. We can say what kinds of points of interest were searched for, how routing was selected, etc.

Do you directly get involved with issues like user privacy?

Yes, we are, we are a European company, so we are GDPR compliant. We are privacy-first. We don't identify users, these are all anonymised sets of data so we only get to see the data probes, rather than who each individual is. We have a clear understanding of what we can and cannot do on the privacy side.

Do you hold your OEM partners to the same standards, since they have more direct access to collect such data?

Our engagement with them will ensure that both of us agree on a basic principle of privacy, which we are answerable to. Of course their responsibility also rests with their relevant authorities in terms of their privacy obligations.

Do you have any closing thoughts about the future of maps?

Location services for two-wheelers are getting very, very popular now. There are mobile applications which are used for two-wheelers, for example mirroring the application on the phone screen. That’s also expanding to the logistics ecosystem, making the transport and supply chain sector more efficient. All these vehicles of different sizes and proportions are moving through the day, so that's also something we see, and so there are various products to deliver.

This interview has been edited for length and clarity.

Royal Enfield Goan Classic 350 Showcased At Tech Exhibition In Israel

Team Ackodrive 26 Feb, 2026, 8:11 AM IST

Government Unveils New Rajmarg Pravesh Portal for Faster Highway NOCs

Acko Drive Team 26 Feb, 2026, 7:50 AM IST

The ePlane Company Opens India’s Largest eVTOL Prototyping Hub at IIT Madras

Acko Drive Team 26 Feb, 2026, 7:17 AM IST

Apollo Tyres Opens Exclusive Outdoor Tyre Testing Centre in Finland to Boost Winter Tyre Development

Acko Drive Team 26 Feb, 2026, 6:27 AM IST

Ferrari's 499P Livery Unveiled: Can Title Defence Survive Rival Upgrades?

Acko Drive Team 26 Feb, 2026, 5:18 AM IST

Looking for a new car?

We promise the best car deals and earliest delivery!