The 400cc bikes have gained popularity among riders who desire the right combination of power, technology, and cost. These bikes are aimed at riders who desire exhilarating experiences without losing such sophisticated features as ABS, ride modes, traction control, and digital displays. Having powerful engines and classy manoeuvres, 400cc bikes can easily fit the highway, the city, and even the weekend outings.In India, 400cc bikes are in demand because riders want a bike that is comfortable to ride and at the same time offers performance and modern innovations. These bikes are the right kind, whether it is speed, safety, or style. In this blog, we present the best 400cc bikes with advanced features so that you can make the right choice that fits well with your riding lifestyle. Now, we can get down to the details and discuss the most promising options at present!

Scooters are popular among everyday commuters for their swiftness, comfort, and practicality. Although many options are available in the market, two that always stand out are the TVS Jupiter and the Suzuki Access.Both are solid in terms of fuel efficiency, price, and reliability. But how does someone choose between the two? A comprehensive comparison of both can help you gain insight into their features, build, and long-term sustainability.That’s where this blog comes to your help. It overviews the key attributes of these two scooters to help you decide. You can also understand their pros and cons to make better decisions.

The Honda Activa 6G was launched in 2020 in India and has since been one of the most popular rides for everyday commuters. The company introduced it to comply with the BS6 emission norms, and since then, this scooter has been upgraded with more features. But do you know if this Activa 6G is a good investment for you? It is only by understanding the USPs, pros, and cons of the scooter that you can decide.This blog comprehensively discusses the reasons why/why not the Honda Activa 6G should be your next purchase. It overviews the key features and technicalities that make the two-wheeler India’s favourite.

A burning clutch smell is one of the most noticeable warning signs your vehicle can give. It usually appears during heavy traffic, hill starts, or frequent stop-and-go driving; moments when the clutch works its hardest.While an occasional whiff is normal, a recurring burnt smell signals that the clutch is slipping, overheating, or experiencing excessive friction. Ignoring these early signs can lead to accelerated wear, expensive repairs, or even complete clutch failure.This guide explains the main causes of a burning clutch smell, the symptoms to watch for, and the steps to fix and prevent clutch overheating. With the right driving habits and timely maintenance, you can extend the life of your clutch and avoid sudden breakdowns.

Every manual transmission vehicle contains the clutch plate, which forms the most critical component of the connection between the engine and the transmission. The clutch plate enables seamless transitions between gear ratios, allows for the operation of the vehicle without the engine stalling, and allows for starting and stopping of the engine.A faulty clutch plate can result in inconsistent and variable vehicle performance due to the inability of the driver to change gears effectively. The delayed engagement of the clutch plate may also create additional stress on the drive system and may be a safety hazard.The clutch plate constantly experiences a high level of friction and heat, which ultimately will deplete the material that comprises the clutch plate. Many drivers are unaware of the critical nature of the component and how it operates, so it is vital to understand the role it plays in a vehicle's overall performance and longevity.

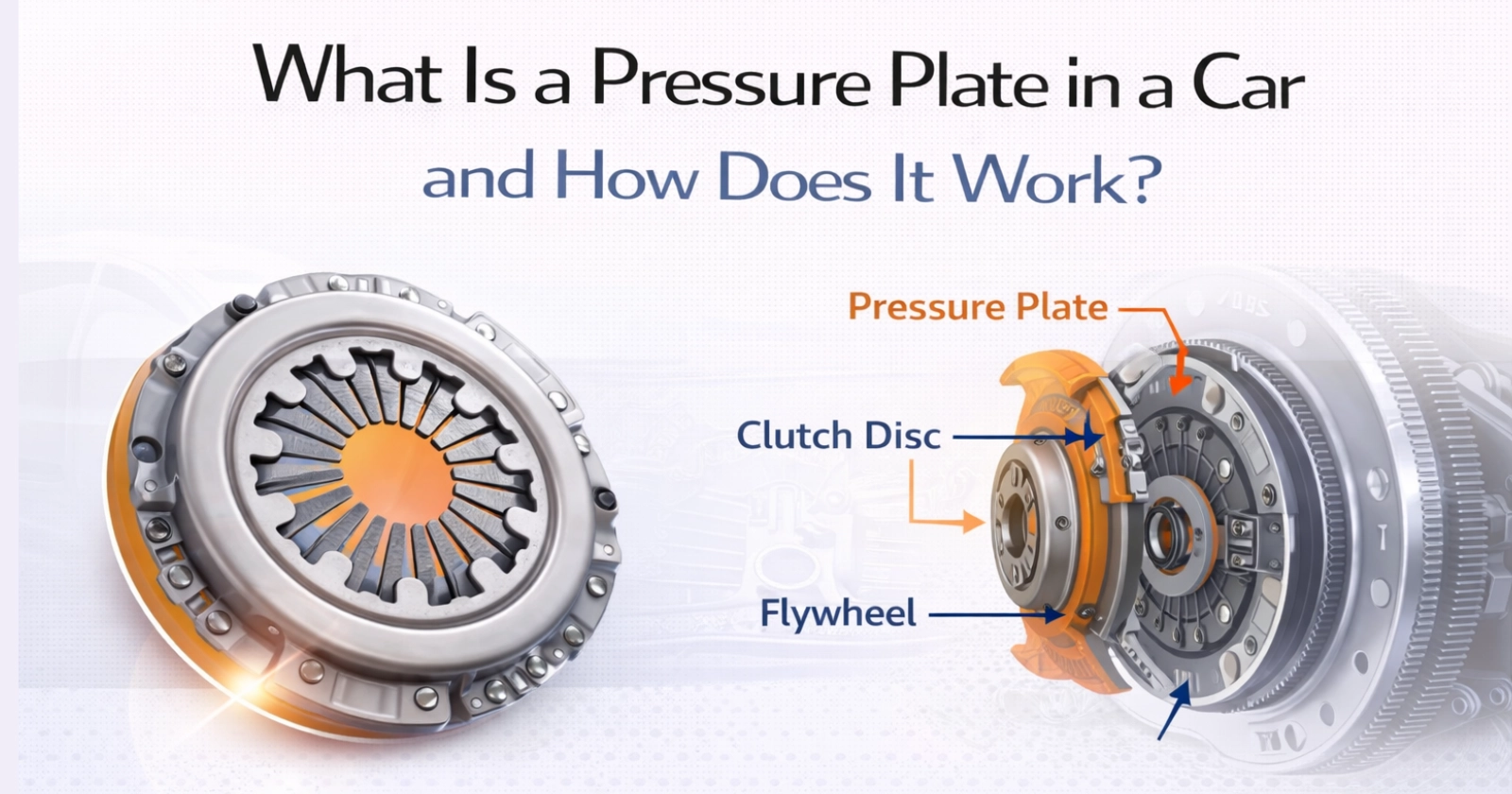

The clutch system in a manual-transmission vehicle transfers power from the engine to the vehicle's wheels. Underappreciated at the centre is the pressure plate.It is an important component that ensures smooth clutch engagement and release: the clutch pressure plate, flanked by the clutch disc, flywheel, release bearing, and clutch pedal, all have important roles to play in ensuring that the driver will be able to shift gears without grinding, stalling, or causing damage to the transmission.Understanding what the pressure plate does, how it works, and the symptoms of failure will help drivers be able to diagnose early clutch problems, maintain smoother gear shifts, and avoid costly repairs. For anyone learning about vehicle maintenance or simply looking to understand their car a little better, the pressure plate is a good starting point.

Knowing which type of headlight will best serve your needs is key when choosing Car Headlight options. The car headlight has evolved from traditional Halogen Headlight Bulbs to many choices, both Laser and Adaptive systems as well.Driving during hours of darkness and/or in inclement weather requires your headlights to provide a level of illumination that will allow for safe driving, along with effective visibility.In this guide, we’ll break down the main types of car headlights, their advantages and drawbacks, and tips for optimising their performance so you can drive safely and confidently, day or night.

When everyone was sending out ‘Happy New Year’ wishes, our Car Drop winner had his inbox full of ‘Happy New Car!’ texts.Yes, the December edition of the ACKO Drive Car Drop has wrapped up successfully, and Pune’s Vipul is about to drive home a sporty SUV that many people dream of owning.

2025 was a great year for automobiles in India, particularly for the motorcycle segment, which saw a 7% growth from 2024 to 2025. Given the significant increase in per capita income in our country, it is not a surprising fact. The vast number of options available, with all the brands providing their services in our country, and the kind of designs, comfort, and technology that we see every day on our Indian roads, it’s tempting for everyone to own something that gives them a sense of power and makes them feel more alive.Industry leaders such as Hero MotoCorp, Honda, TVS, Bajaj, and Royal Enfield continue to dominate the market. They have retained the trust of Indian riders with their reliability, performance, and practicality. Read on to know more about the best-selling bikes in November 2025.

Are you ready to buy your dream car that suits all your requirements? A car is a significant and substantial investment. One must choose it very wisely. It is not just about a vehicle, as it grows with your family and vice versa. Here, read all about the top 10 best-selling cars in India in November 2025. Know all about the several key factors behind a car’s outstanding sales, so that you can make an informed decision.

Mahindra Bolero Mileage: Real World vs ARAI Mileage

Acko Drive Team 9 Mar, 2026, 11:20 AM IST

Mahindra XUV700 Mileage: Real World vs ARAI Mileage

Acko Drive Team 9 Mar, 2026, 10:19 AM IST

Top 10 Best-Selling Bikes in January 2026

Team Ackodrive 16 Feb, 2026, 3:46 PM IST

Top 10 Best-Selling Cars in January 2026

Team Ackodrive 16 Feb, 2026, 3:12 PM IST

Honda Amaze Service Schedule and Maintenance Costs

Team Ackodrive 6 Feb, 2026, 2:51 PM IST

Looking for a new car?

We promise the best car deals and earliest delivery!