The Government of India will revise the GST rate into two simpler slabs – 5% and 18%.

Share Post

The Government of India will revise the GST rate into two simpler slabs – 5% and 18%.

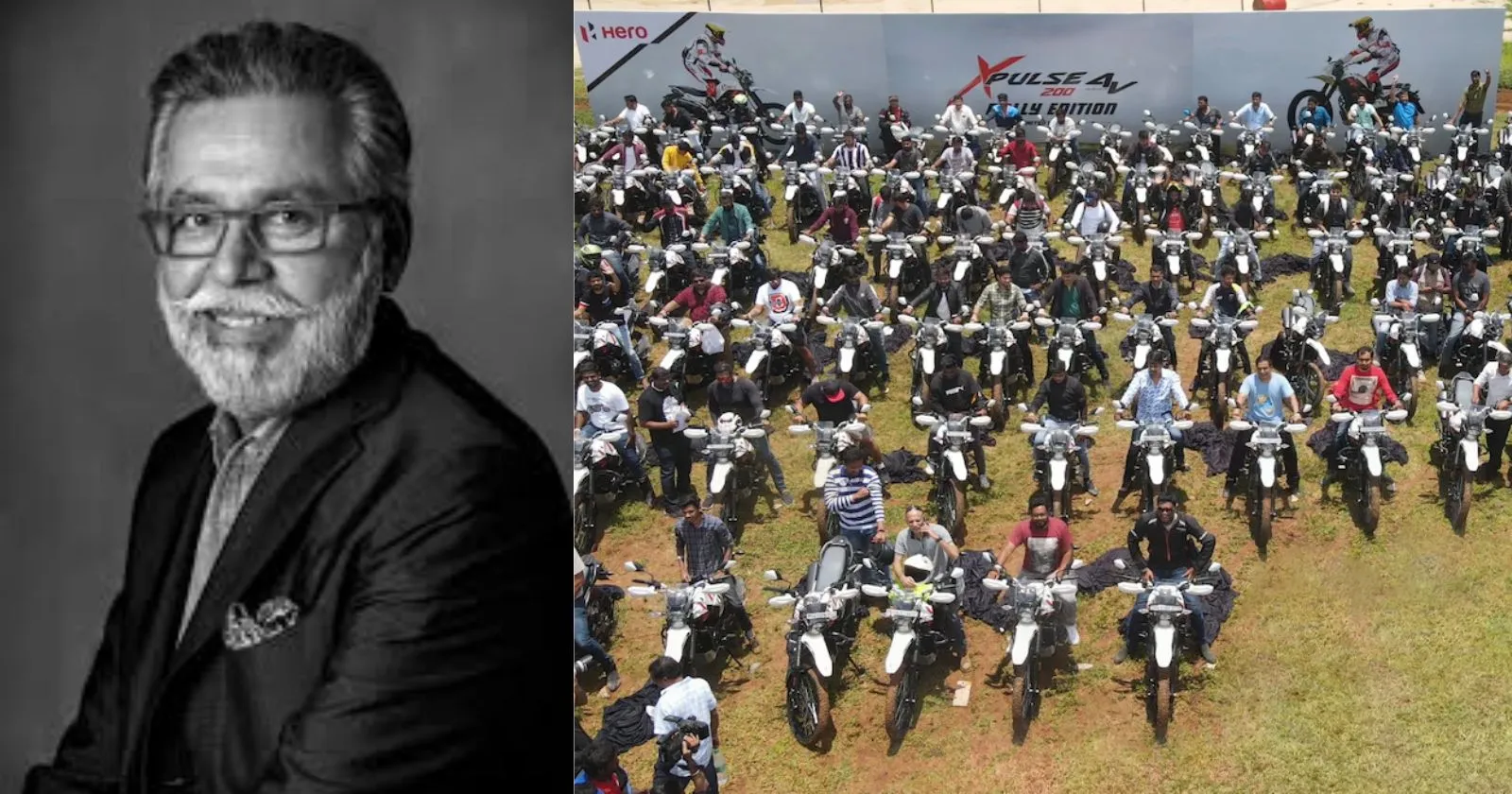

The Chairman and Managing Director of Hero MotoCorp, Pawan Munjal, has upheld the Government of India’s decision to revise the GST rate into two simpler tabs – 5% and 18%. This, in turn, will eliminate the existing 12% and 28% slabs. “This progressive step will serve as a crucial enabler, offering much-needed relief to first-time buyers—particularly in rural and semi-urban areas—where two-wheelers remain the backbone of personal mobility,” Munjal noted.

On the other hand, Royal Enfield’s bossman, Siddhartha Lal, last week had requested the Government to tax two-wheelers uniformly, referring to the third tax rate of 40%, which is being considered for bikes with engine capacity of 350 cc and above. “A uniform GST of 18% across all two-wheelers is critical,” Lal had stated. “Lowering of GST for <350cc will help broaden access, but raising GST for >350cc would damage a segment vital to India’s global edge,” Lal had argued in the Instagram post.

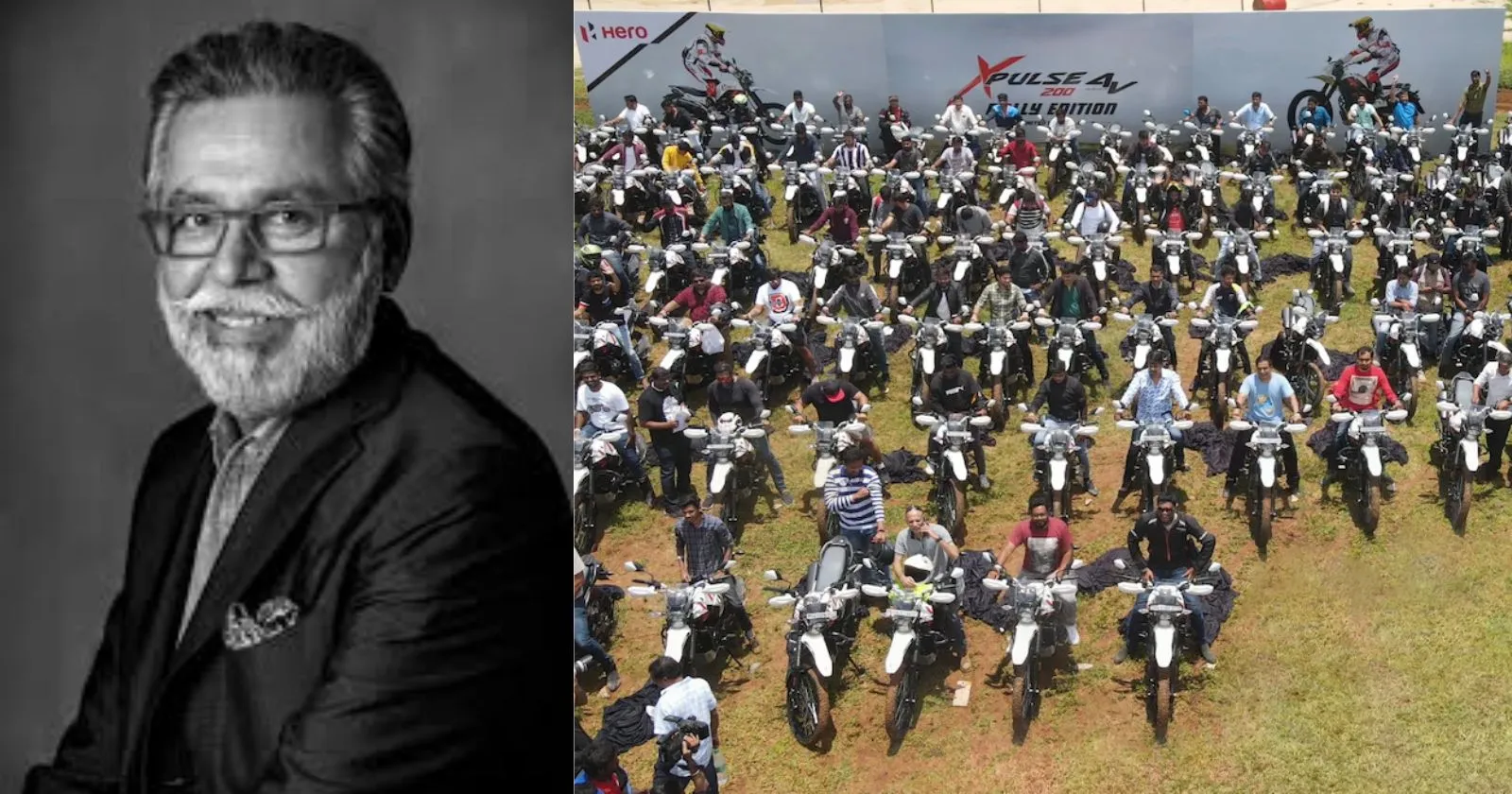

While Hero MotoCorp’s portfolio consists primarily of bikes and scooters ranging from 100 cc to 250 cc – so its portfolio stands to gain a uniform tax rate of 18%. However, Royal Enfield’s portfolio consists of bikes that start from 350 cc, followed by the 450 cc Himalayan and Guerrilla, and topping out with the 650 cc parallel-twin family. If bikes above 350 cc are taxed with 40% GST, then the brand might lose a lot of potential customers, simply due to an increase in its asking price. That might not be the case for Hero MotoCorp, but in the future, it might get affected when the bigger Hero XPulse 421 hits the market.

And yet, Hero MotoCorp’s portfolio will primarily comprise entry-level commuters. “The two-wheeler industry is not only a key driver of mobility but also a vital pillar of the national economy, contributing substantially to government revenues and generating employment across its value chain. By stimulating growth in this sector, the government has reaffirmed its commitment to empowering the common citizen while strengthening the foundation for long-term competitiveness under the “Make in India” vision,” Munjal concluded.

Tata Punch EV Launch Tomorrow: Features, Specs, Price Expected

Acko Drive Team 19 Feb, 2026, 6:14 PM IST

JSW Begins Independent Journey in India’s Auto Industry with CVs

Acko Drive Team 19 Feb, 2026, 5:03 PM IST

Volkswagen Tayron R-Line Launched In India, Priced At ₹46.99 Lakh

Acko Drive Team 19 Feb, 2026, 2:52 PM IST

iOS 26.4 CarPlay Public Beta Previews Video Functionality, Conversational AI Apps

Acko Drive Team 19 Feb, 2026, 2:36 PM IST

Audi SQ8 India Launch on March 17: What to expect

Acko Drive Team 19 Feb, 2026, 2:14 PM IST

Looking for a new car?

We promise the best car deals and earliest delivery!